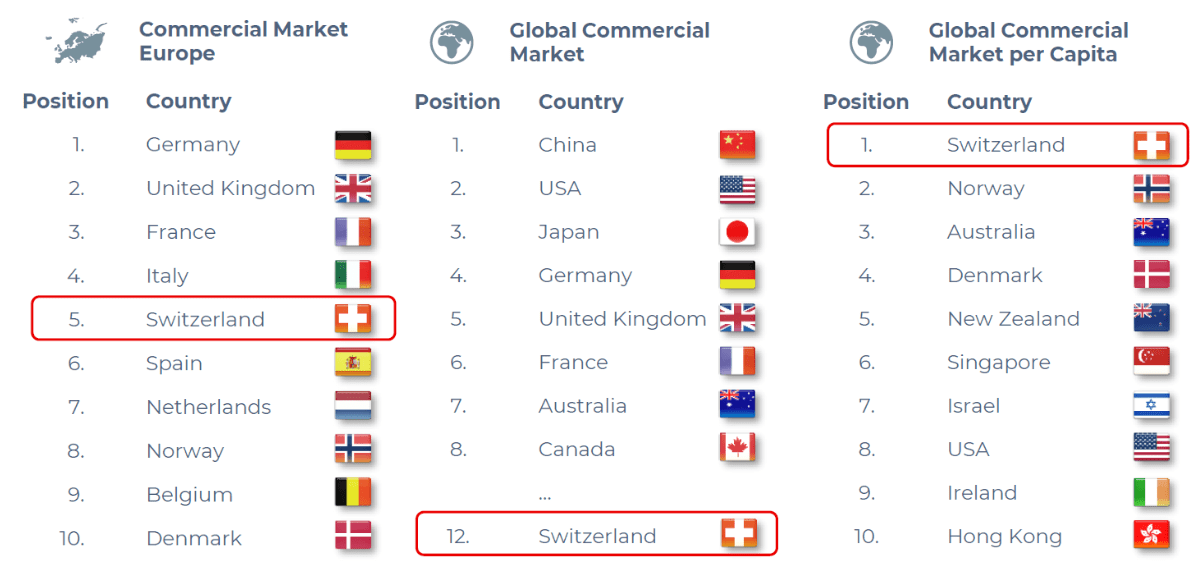

Key facts & figures from the report

- 6500 people are working in the Swiss drone industry.

- Switzerland ranks #8 globally in funding for drone companies.

- Switzerland ranks #1 globally in market size per capita.

- Swiss drone industry generated revenue of 569m CHF in 2024, which is expected to grow to 871m CHF in 2030.

- Advantages of being a Swiss drone company: Talent availability, being “Swiss-made”, ecosystem & network, quality of life.

What are some of the unique selling points of the Swiss drone industry?

Switzerland has a very stable environment for companies to experiment and commercialize their solutions. The Swiss-made label continues to shine worldwide, and Swiss-made products/services are known to have a very high level of technological maturity. Switzerland is also unique in the sense that the EU regulatory framework applies and allows companies to access the EU market while having a strong education and research ecosystem supported by the ZHAW as well as the ETHZ and the EPFL.

How did Switzerland establish itself as the world leader in market size per capita for drones, and what strategies can be adopted to maintain this position?

Switzerland had unique conditions for the development of the drone sector, with a strong research and development ecosystem in areas like robotics or artificial intelligence. However, the EU regulation and its recent entry into force have brought some administrative burden upon Swiss companies that would like to design or fly drones. The EU regulatory framework is relatively new and is not yet mature enough for some companies to generate revenues. Therefore, it is paramount for the industry to come up with proposals to further improve this new regulatory framework and for regulators to create a framework that accommodates the needs of the industry.

How does the drone ecosystem in the Greater Zurich Area compare to the rest of Switzerland?

The Greater Zurich Area is home to some of the most innovative companies in the Swiss drone ecosystem. The presence of ETHZ and ZHAW but also of numerous companies that would like to use drones to improve logistics drives the creation of innovative projects and enterprises (e.g. Verity, Tinamu, Voliro).

What makes the Greater Zurich Area a hub for the drone industry, and what strategies can be implemented to retain this position?

Drones can greatly simplify processes and make tasks less time-consuming. There are now many available drone solutions made in Switzerland that provide this added value. To keep this leading role, it is important that the regulators and the industry actively communicate to create simple standards that allow Swiss companies to access the market. Furthermore, the public acceptance of drones is also hindering the deployment of this technology. Therefore, it is paramount for drone companies and the public sector to communicate the positive added value of drones to the greater public. Another element that is yet missing and may accelerate research and foster innovation is the creation of a test infrastructure dedicated to drones and advanced air mobility.

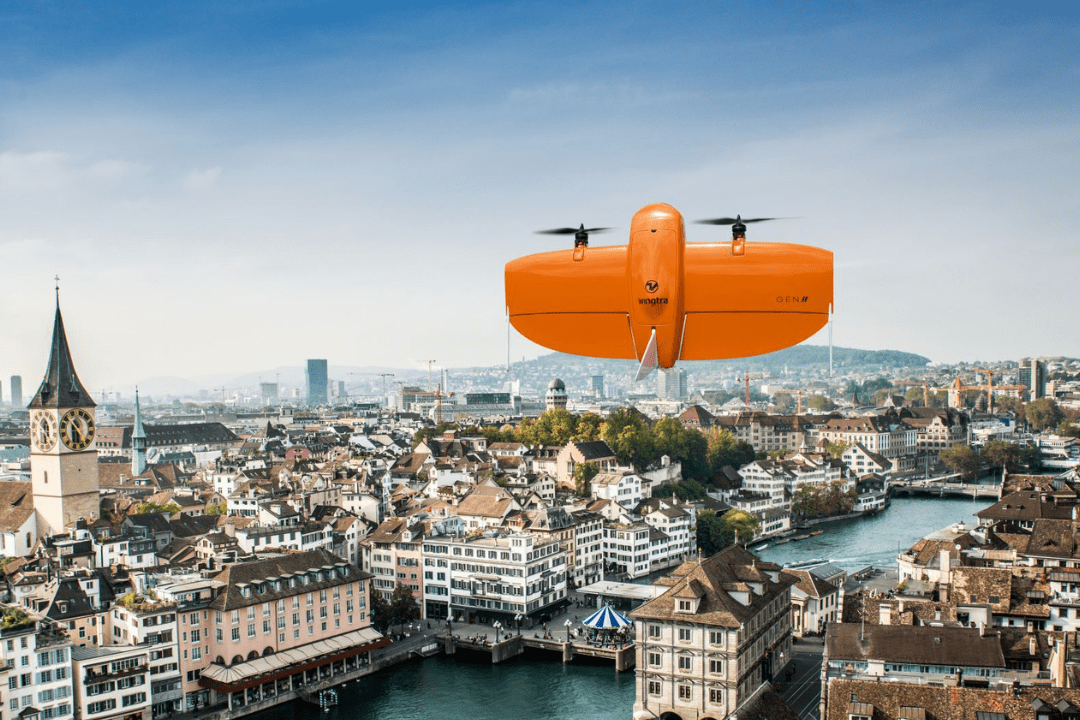

Drone technology in the Greater Zurich Area

Drone technology in the Greater Zurich Area

The Greater Zurich Area is the world’s leading location for the development of core technology for drones and robots in commercial applications. There are several leading universities here, such as ETH Zurich and the University of Zurich. These universities are home to a large and active community of developers, numerous drone and component manufacturers and innovation-friendly authorities. Greater Zurich’s contributions to drone technology further solidify its reputation as the “Silicon Valley of Robotics”.

What role does academia play in fostering innovation in the Swiss drone industry?

Academia is at the heart of the creation of the rich drone ecosystem we have in Switzerland. The ETHZ with its many research labs in the fields of robotics and artificial intelligence has contributed heavily to the creation of the current drone companies. In the Greater Zürich Area, the ZHAW is also a major contributor to the drone ecosystem with its Center for Aviation (ZAV) which is performing many research projects related to urban air mobility and E-VTOLs. The research is usually not limited to engineering but also goes into topics like airspace integration, the societal acceptance of drones (by the BRIDGE Lab of the University of Zurich for example), or the work of the Center for Aviation and Space Competence of the University of St.Gallen.

Considering the expected growth in the drone market, what strategic approaches should companies take to increase their market share? How can they benefit from the ecosystem in the Greater Zurich Area?

It is essential to act to ensure that the regulatory framework is further tailored to the needs of drone operators and manufacturers. The participation in industry associations like the Drone Industry Association Switzerland and the contribution to competence groups at European levels can help to improve the legal framework. Furthermore, manufacturers should join standard development organizations to participate in the writing of standards that will make the complex usage of drones possible in the near future.

What emerging technologies and future trends should Swiss drone companies focus on to stay ahead in the rapidly evolving global market?

Swiss companies should participate actively in the rulemaking process to make sure that future rules are adapted to their needs. In this context and in order to enable the full potential of drones, Swiss companies need to detect and avoid other aircrafts when operating beyond the visual line of sight of the pilot. To achieve this aim, Swiss companies, together with existing aviation stakeholders, need to search for solutions for electronic conspicuity that allows all aviation stakeholders to be visible.

Drone Industry Association Switzerland

Drone Industry Association Switzerland

The Drone Industry Association Switzerland (DIAS) represents, supports, and promotes Swiss companies involved in drone-related products and services. DIAS focuses on advancing the safe and innovative use of drones, facilitating export activities, and enhancing the global competitiveness of Swiss drone businesses. The association also collaborates with other organizations to address industry challenges and foster growth.

The report identifies funding and regulation as the main challenges for leveraging drone technology. What specific regulatory changes are necessary to secure Switzerland's competitive advantage in the global drone market?

Many Swiss companies agree on the fact that the current EU regulatory framework is limiting operations too much when it comes to the distance from people. There are different solutions possible, for instance:

- Reducing the burden of flying in the so-called European standard scenarios (STS-01 and STS-02) by making the compliance part of the standard scenarios lighter. This could be done, for example, by not requiring an operation manual for the standard scenarios for which the pilot must be trained, and the drone must have a Class C marking. Therefore, the requirement for a rather lengthy operations manual, which would be a self-declared exercise, seems somewhat exaggerated in this context. Furthermore, as it is a self-declared requirement, there is a high probability that the quality of such manuals will be rather low and that the authorities will have a significant workload in auditing such operations. Therefore, reducing the complexity of such scenarios from a procedural point of view would probably make a lot of sense.

- Reducing the distances or the requirements within the open category. Especially the distances from residential, industrial, recreational, and commercial areas in the OPEN category A3 (For drones up to 25 kg) are defined as 150m AGL which is deemed by many to be extremely conservative. Reducing this to a more appropriate distance, or even removing it altogether, could probably ease many operations. Operations are also limited to a distance proportional to the flight altitude which makes this requirement rather redundant and further constraining for the safety of people on the ground.

- Finally, let’s mention also the current Cx class marking process, which does not allow product changes to be managed cost-effectively. The drone industry is marked by rapid changes in design and software and needs flexible regulation to accommodate those changes. The Cx class marking process requires that each modification is reassessed by a Notified Body to ensure quality and safety. It would be important to introduce some flexibility, especially for design changes where a reassessment by a Notified Body would not be required.

How can Swiss drone companies attract more later-stage funding to fuel their expansion and innovation efforts?

Here, the challenge is to be able to have a cost-effective Swiss production. This strongly relates to the current strong value of the Swiss franc compared to foreign currencies. This puts some pressure on companies that decide to produce drones in Switzerland. Let’s note however that they get the advantage of the “Swiss-made” label. Therefore, it is important that this label remains a high-value label that can compensate for the high value of the Swiss franc. This can only remain the case if Switzerland maintains its research-driven environment with unique competencies worldwide. Therefore, the salaries need to remain attractive, and our research and innovation centers need to keep their leading positions.

Where do you see the Swiss drone industry in the next 5 to 10 years?

I believe that the EU regulation will further mature and that Switzerland will also become a leader when it comes to regulation. We are already seeing a number of top-quality consultancy firms working on drone compliance and regulation issues in Switzerland. Therefore, my personal take on the Swiss drone industry is that it will grow even more than identified in the report.

Download the report & related documents

Discover the strengths and competitiveness of the Swiss drone market.

Learn about the advantages and regulations for international drone companies in Greater Zurich.

Discover the key reasons why the Greater Zurich Area is the world's leading innovation hub.

Meet with an expansion expert

Our services are free of charge and include:

- Introduction to key contacts in industry, academia, and government

- Advice on regulatory framework, taxes, labor, market, and setting up a company

- Custom-made fact-finding visits, including office and co-working space