In future, small and medium-sized enterprises (SMEs) in Switzerland will be in a position to professionally and efficiently process foreign exchange transactions in real time or on the basis of forward contracts. To this end, WIR Bank Genossenschaft is launching the FX Trading platform, as outlined in a press release. The bank’s foreign exchange margin is not dependent on the volume of the transactions. “Even for small transactions, our customers trade at rates that other providers only apply to transactions upwards of 250,000 Swiss francs”, comments Matthias Pfeifer, Head of Private and Corporate Clients at WIR Bank, in the press release. Moreover, customers are also able to make partial payments for forward transactions or retrospectively adjust the value date.

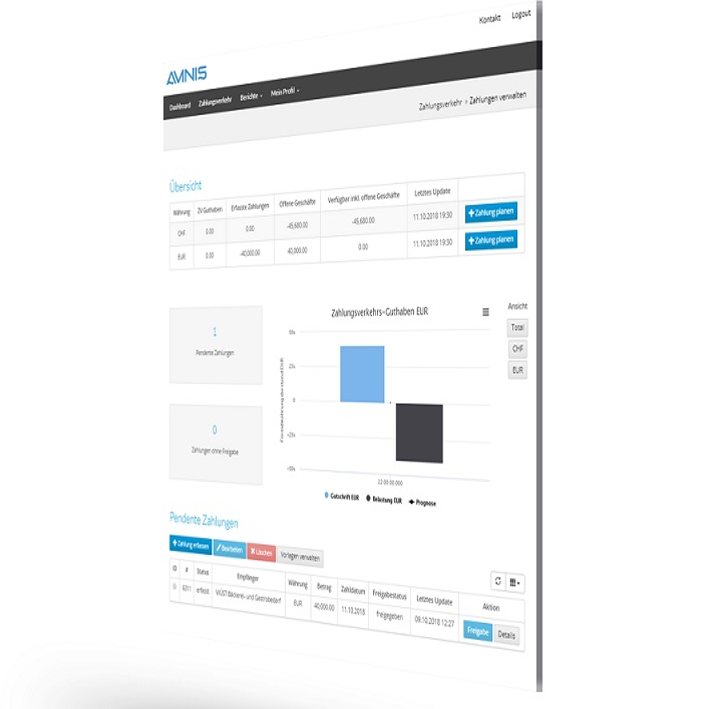

To achieve this, WIR Bank is working together with Amnis Treasury Services AG. The Zurich-based fintech was founded back in 2014 and offers SMEs digital solutions for currency transactions. In 2019, more than 400 clients used Amnis to transact currency operations in the amount of 488 million Swiss francs, an increase of 115 percent versus the prior year.

Amnis now has plans to expand internationally. According to a press release issued in mid-April, the focus of these plans will be on the neighboring countries of Germany, Austria and Italy. With this in mind, Amnis successfully closed a financing round with the Spicehouse Swiss Venture Fund, headquartered in Zug, as the lead investor. “Our aim is to gain a foothold with our solution in additional core markets as quickly as possible”, explains Michael Wüst, Co-Founder and CEO of Amnis, in the press release.

Related news

Meet with an expansion expert

Our services are free of charge and include:

- Introduction to key contacts in industry, academia, and government

- Advice on regulatory framework, taxes, labor, market, and setting up a company

- Custom-made fact-finding visits, including office and co-working space