Are you thinking about opening a European headquarters, R&D center, or branch office for your company in Switzerland?

The Greater Zurich region offers one of the fastest and most straightforward company formation processes in Europe. Our expert team guides you through every step – from choosing the right legal structure and handling permits to securing office space and hiring talent - all free of charge. Company formation typically takes 2–4 weeks.

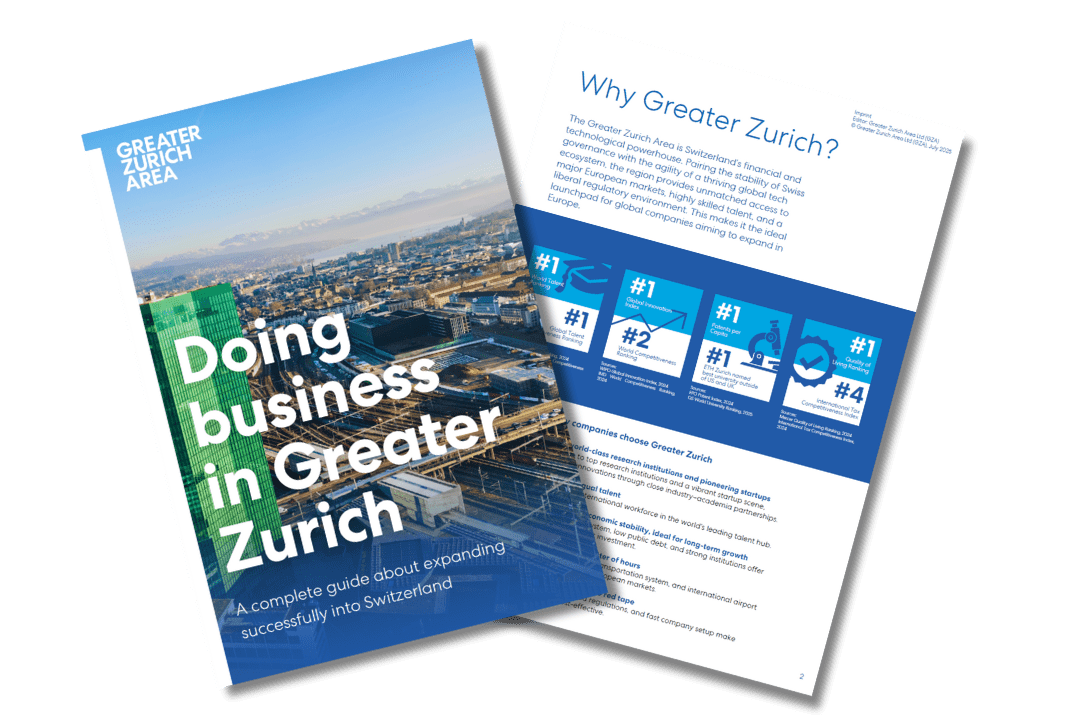

Get key insights with our Business Guide

Get key insights with our Business Guide

Learn about

- the top reasons why Greater Zurich is a leading business hub in Europe,

- tax advantages and financial incentives,

- talent insights – why Switzerland ranks #1 in global talent competitiveness and what that means for your hiring,

- Switzerland’s regulatory and legal framework,

- and much more.

Step by step checklist for setting up a company in Switzerland

Unless you are already in Switzerland and speak the local language, the practical way is to engage a lawyer, consultant or fiduciary to establish your Swiss company (a fiduciary is a Chartered Accountant with substantial legal knowledge, without being a proper lawyer). The main steps may be summarized as follows:

1. Choose your preferred legal form

2. Have foundation documents drawn up by a fiduciary or lawyer

3. Review and sign documents and have signatures authenticated by a notary public or municipal administration (varies by canton)

4. Deposit capital

5. Return foundation documents and confirmation of capital deposit

6. Company is founded and registered in the commercial registry

Legal forms

There are no particular restrictions on foreign owned companies in Switzerland. The four main types of legal forms in Switzerland are:

- Limited Liability Company (GmbH; minimal capital CHF 20,000)

- Public Limited Company (AG; minimal capital CHF 100,000)

- Sole Enterprise (no capital required)

- Limited Partnership

All legal forms will require one person residing in Switzerland. You can find an overview of the main legal forms and their advantages and disadvantages as well as checklists to found a company on www.startups.ch and www.gruenden.ch.

Costs

The costs of founding a company are different in every canton and dependant on the legal form and company size. Following benchmarks can be applied:

- Public limited company (AG): CHF 1750 - 3,000*

- Limited liability company (GmbH): CHF 1230 - 2,000*

- Sole enterprise: CHF 500 - 900

- Limited partnership: CHF 300 - 900

* Normally, we recommend that you have the company incorporated by a fiduciary or attorney; in this case, the cost is CHF 3,000-4,000 all inclusive. Additional costs of approximately CHF 1,000 will arise when founding an AG or GmbH for an audit certificate, incorporation report and agreement on the contribution in kind.

Additionally, you will also need contracts:

- Employment contract: CHF 230 - 750

- Terms and Conditions (AGB): CHF 300 - 1,000

- Shareholders’ agreement: CHF 950 - 2,000

- Articles of association: CHF 750 - 2,000

- Trademark protection: CHF 300 - 1,000

Discover our free services - we support you on every step of your expansion project

Watch the video to find out how we help companies set up and grow in Switzerland.

Meet with an expansion expert

Is Greater Zurich on your expansion radar? We support you on every step of your expansion journey - from location evaluation to fact finding visits.

Our services are free of charge and include:

- Introduction to key contacts in industry, academia, and government

- Location evaluation support to find the ideal base for your business

- Advice on regulatory framework, taxes, labor, market, and setting up a company

- Custom-made fact-finding visits, including office and co-working space

- And much more, customized to meet your needs.