In light of the developments we have seen in the past years on the international tax landscape, the Swiss Federal Council decided to amend the existing corporate tax law to ensure Switzerland will also in the future be able to provide for a corporate tax burden which is reasonable and competitive in an international comparison, acceptable under the current developments (e.g. BEPS; Base Erosion and Profit Shifting) and affordable in terms of generating the revenues needed by the state to fulfill its functions.

Since any type of ring-fencing of income is not accepted anymore by the international community, current tax privileges such as the cantonal holding privilege or the so called mixed or administrative company privilege need to be abolished. This will also affect those companies currently benefitting from such privileges based on a tax ruling. These rulings will be void from the day the CTR III becomes effective.

However, a number of new or temporarily available measures will allow these and also new companies to still achieve low tax rates within the next 5 to 10 years.

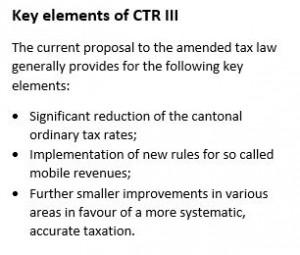

The proposed measures at a glance:

Apart from the above mentioned abolishment of cantonal tax privileges and the reduction of the ordinary profit tax rates, the current proposal provides for the following measures to increase the attractiveness of the Swiss corporate tax law:

- Implementation of a patent box at cantonal level;

- Additional deductions of R&D costs;

- Reduced capital tax;

- Abolishment of stamp duty on equity;

- Step-up (related to hidden reserves).

In particular: Patent box

Although Switzerland is going to recognize and accept the international standard and the respective developments of the patent box driven by the OECD, this tool will allow for a significant reduction of income derived from patents and the like. It is too early to define what exactly ‘and the like’ will mean in practice. However, it will most probably be income from assets which are protected by a certain type of legal means, e.g. in the medical sector.

As defined by the OECD, within the BEPS project only income from assets which were developed and produced locally (i.e. in the same jurisdiction), plus a 30% uplift for development and production costs abroad, will qualify for preferred taxation (so called modified Nexus approach). In addition, R&D costs for unsuccessful research can be set off against ordinary profit of a company from other sources.

The effective tax rate of income qualifying for the patent box will be approximately 10%.

Additional deductions of R&D costs (input deduction):

Input deduction means that a company performing R&D activities, including innovation activities, will be granted an increased (i.e. more than 100%) deduction of the respective costs from its taxable income. The multiple can be defined by each canton and therefore can give rise to inter-cantonal tax competition. These additional deductions will be granted for both R&D activities performed for internal use and upon assignment by third parties.

The effect of these reductions is similar to a tax credit granted in many other jurisdictions on R&D activities.

Further improvements: reduced capital tax and abolishment of stamp duty on equity

Both measures allow for the financing of a company without any need to consider significant capital taxes or stamp duty (under current law 1%) and may make Switzerland an attractive location to establish ‘strong’ legal entities, such as headquarters for multinational companies, basically ending up with the same tax position as under the current holding status. The important abolishment of the stamp duty is a particularly relevant improvement for companies performing group financing activities etc.

Step-up:

As a completely new instrument, a company relocating its domicile or certain functions from abroad to Switzerland will be allowed to identify its hidden reserves at the moment of such relocation and subsequently, by way of depreciation, reduce its tax base. To the extent hidden reserves cannot be allocated to certain assets, they can be determined as goodwill and can – only for tax purposes, without any impact on the balance sheet under IFRS – be amortized within up to ten years.

On the other hand, consequently, if a company is leaving Switzerland or transferring relevant functions from Switzerland to any other jurisdiction, the respective hidden reserves may be disclosed and taxable in Switzerland.

In addition, the proposed amendments will allow companies, which currently benefit from a cantonal tax privilege, to realize any value generated under this regime, within five years after the new law becomes effective. In fact, this provision will allow a limited type of grandfathering to the extent the respective company is able to disclose and identify the respective hidden reserves.

Conclusion:

The amended corporate tax law will allow larger and smaller companies, among them start-ups with R&D activities, headquarters of multinational companies or any other innovative companies to benefit from internationally low tax rates on a level playing field. The different measures highlighted above, in combination with the reduced ordinary corporate income tax rates on cantonal level, may for many companies lead to tax rates of around 10 or 11% during the next 5 to 10 years. But even just the use of the future ordinary tax rates will allow for an effective tax rate of 12 to 14%.

The amended law is, depending on the political process, expected to enter into force as per 2018 or 2019.

About the author

Christoph Niederer, Attorney at Law, Swiss Certified Tax Expert and Partner at VISCHER, primarily advises companies and private individuals on international tax law and procedural and criminal tax law. His clients include several multinationals from various industrial sectors. He also has extensive experience in structuring company sales. In addition to his work as an attorney, Christoph is a lecturerer within the graduation program for certified accountants and a speaker on many other events.

VISCHER is one of Switzerland’s leading law firms. Their attorneys, tax advisors and notaries will help you with a wide variety of legal matters – promptly, reliably and with the utmost expertise.

Meet with an expansion expert

Our services are free of charge and include:

- Introduction to key contacts in industry, academia, and government

- Advice on regulatory framework, taxes, labor, market, and setting up a company

- Custom-made fact-finding visits, including office and co-working space