In total more than CHF 1.5 billion, which is the majority of the venture capital, flows into start-ups from Greater Zurich as new data from Venturelab shows. Start-ups based in the Canton of Zurich are of particular interest to venture capitalists, having raised CHF 1.23 billion in equity financing last year. The Canton of Vaud came in second place, with just over one-third this amount (CHF 464 million), followed by the Canton of Zug with CHF 207 million (CHF 180 million of which went to the biotech company Arvelle Therapeutics). The Canton of Basel came in fifth place.

According to the website startup.ch, the strong position of Zurich and Vaud reflects the influence and importance of the two Swiss Federal Institutes of Technology in Zurich and Lausanne as key drivers of innovation in Switzerland.

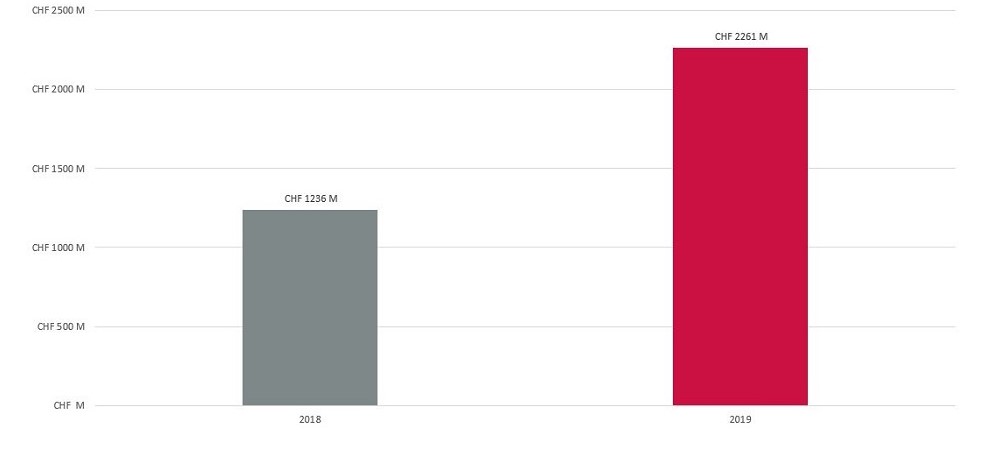

The total capital investment in Swiss start-ups reached a record high of CHF 2.26 billion in 2019, representing an 83% increase over the previous year. Later stage financing grew to more than CHF 1.6 billion or nearly three quarters of the total money invested. In contrast, seed financing was only CHF 73 million and early stage capital was CHF 549 million.

The majority of capital was invested in ICT (CHF 711 million) and biotech (CHF 675 million) start-ups, followed by fintech (CHF 378 million), engineering (CHF 250 million), cleantech (148 million) and medtech (CHF 98 million).

Venturelab provides support to Swiss start-ups and works closely IFJ, an institute for start-ups that is based in Schlieren, St.Gallen and Lausanne.

More news

Meet with an expansion expert

Our services are free of charge and include:

- Introduction to key contacts in industry, academia, and government

- Advice on regulatory framework, taxes, labor, market, and setting up a company

- Custom-made fact-finding visits, including office and co-working space